Yes, to Annexation!

Let's talk Annexation ......

YEs!

What is Annexation?

Annexation is the process of bringing property into the City limits. It is one of the primary means by which cities grow. Cities annex territory to provide urbanizing areas with improved municipal services.

You should be receiving a survey from the County on Annexation. Before you send it, please read the below letter which has also been mailed to you so that you can have all of the information you need to make an informed decision. Remember you can contact us directly if you need any information.

VOTE IN FAVOR OF ANNEXATION!

February 13, 2023

[BUSINESS OWNER]

[BUSINESS ADDRESS]

Maria Puente Mitchell, Mayor Cell (305) 962-5545 mitchellm@miamisprings-fl.gov

CONTACT INFORMATION

William Alonso, City Manager Office (305) 805-5011 alonsow@miamisprings-fl.gov

Dear Property/ Business Owner:

You should have received a survey from Miami-Dade County asking if you are in favor of a Miami Springs boundary change (annexation). Before you respond,

please take a few moments to get the facts on the boundary change request:

The current Miami Springs millage rate of 6.91 does NOT apply, and will NOT apply, to your tax bill or any property owner tax bill in the annexation area.

Why?

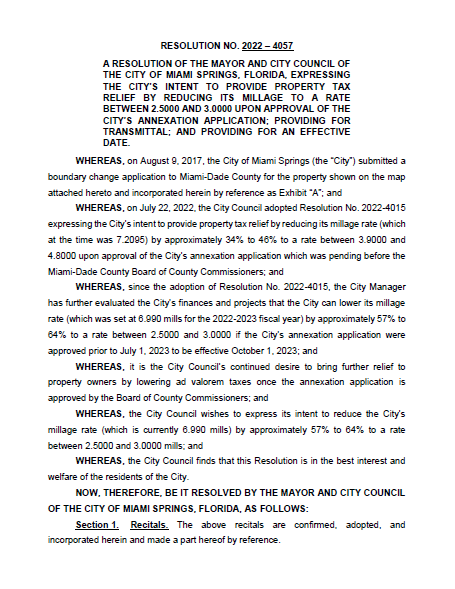

In December 2022, the Miami Springs City Council adopted Resolution No. 2022-4057 and officially submitted it to the County stating that upon the boundary

change, the City intends to lower the millage to 2.5 – 3.0 mills, which represents less than a $500 per year tax increase for the majority of property owners.

Will the boundary change (annexation) result in a big tax increase for all property owners?

No. As per Resolution 2022-4057, the City intends to adjust its millage rate to 2.5 -3.0 mills upon annexation. This represents as little as $500 or less yearly tax

increase for the majority (60%) of property owners in your area!

What will the tax bill be for my property at the 2.5 - 3.0 millage rate?

Please contact City Manager William Alonso directly and he will quickly tell you what the difference in tax dollars will be for your specific property and answer

any questions. He can be reached by phone at (305) 805-5011 or email alonsow@miamisprings-fl.gov.

What are the benefits of annexation to me, as a property owner?

As your neighbor, we have known about your needs for decades. Upon annexation, the City commits to increased police services and significant infrastructure

improvements to your roads, storm water systems/flood controls, street lighting, traffic and safety problems. You will also benefit from improved access to

permitting and City services and direct access to City Officials. The City will create an Advisory Board composed of your representatives so you have a voice at

City Hall and in expanding the future business opportunities for your area.

Why will annexation mean that I get even more return for my property tax dollars?

Did you know that the County considers you a “donor” area? This is because most of the property tax revenues you currently pay to the County are re-distributed

by the County to their projects and other “non-donor” areas of unincorporated Miami-Dade County. When you become part of Miami Springs, your property

taxes will remain local, to make significant improvements to your roads, flooding, lighting, and traffic problems, as well as provide improved police services and

response time.

We know you continue to receive misinformation about ridiculous tax hikes and other scare tactics from a small, but well-funded group. They ignore and deny

the very real problems of flooding, deteriorating roads, traffic, and delayed police services that have been occurring and increasing in your area for over 20 years.

Only you are aware of the negative and costly impacts that these conditions create for your business and your future business opportunities.

We welcome the opportunity to give you the facts about annexation and answer any questions. Our City Manager William Alonso and I are available to you

by phone, email, or to meet at your location or ours. Please do not hesitate to reach out to one of us at the contact information below.

Looking forward to the opportunity to listen to you, answer your questions, and chart a successful future together!

Best Regards,

Maria Puente Mitchell, Mayor

City of Miami Springs

VISIT THE CITY OF MIAMI SPRINGS ANNEXATION WEBSITE AT: WWW.YES-TO-MIAMISPRINGS-ANNEXATION.COM

201 Westward Drive - Miami Springs, Florida 33166

Tel: (305) 805-5006 Fax: (305) 805-5028

City of Miami Springs

Maria Puente Mitchell, Mayor

Office of the Mayor

13 de febrero de 2023 [BUSINESS OWNER]

[BUSINESS ADDRESS]

Maria Puente Mitchell, Mayor Cell (305) 962-5545 mitchellm@miamisprings-fl.gov

CONTACT INFORMATION

William Alonso, City Manager Office (305) 805-5011 alonsow@miamisprings-fl.gov

Estimado dueño de propiedad/negocio:

Debería haber recibido una encuesta del condado de Miami-Dade preguntándole si está a favor de un cambio de límites (anexión) de Miami Springs. Antes de

responder, tómese unos momentos para conocer los hechos sobre la solicitud de cambio de límites:

La tasa de millaje actual de Miami Springs de 6.91 NO se aplica, y NO se aplicará, a su factura de impuestos ni a ninguna factura de impuestos de

propietarios en el área de anexión. ¿Por qué?

En diciembre de 2022, el Concejo Municipal de Miami Springs adoptó la Resolución No. 2022-4057 y la presentó oficialmente al Condado indicando que tras el

cambio de límites, la Ciudad tiene la intención de reducir el millaje a 2.5 – 3.0 mills, lo que representa menos de $500 por aumento anual de impuestos para la

mayoría de los propietarios.

¿El cambio de límites (anexión) resultará en un gran aumento de impuestos para todos los propietarios?

No. Según la Resolución 2022-4057, la Ciudad tiene la intención de ajustar su tasa de amillaramiento a 2.5 -3.0 mills tras la anexión. ¡Esto representa un

aumento de impuestos anual de tan solo $500 o menos para la mayoría (60%) de los propietarios en su área!

¿Cuál será la factura de impuestos para mi propiedad con una tasa de amillaramiento de 2.5 - 3.0?

Comuníquese directamente con el administrador de la ciudad, William Alonso, y rápidamente le dirá cuál será la diferencia en dólares de impuestos para su

propiedad específica y responderá cualquier pregunta. Se le puede contactar por teléfono al (305) 805-5011 o por correo electrónico alonsow@miamisprings-

¿Cuáles son los beneficios de la anexión para mí, como dueño de una propiedad?

Como su vecino, conocemos sus necesidades desde hace décadas. Tras la anexión, la Ciudad se compromete a incrementar los servicios policiales y mejoras

significativas en la infraestructura de sus carreteras, sistemas de aguas pluviales/controles de inundaciones, alumbrado público, tráfico y problemas de

seguridad. También se beneficiará de un mejor acceso a los permisos y servicios de la Ciudad y acceso directo a los funcionarios de la Ciudad. La Ciudad creará

una Junta Asesora compuesta por sus representantes para que tenga voz en el Ayuntamiento y en la expansión de futuras oportunidades comerciales para su

área.

¿Por qué la anexión significará que obtendré aún más ganancias por el dinero de mis impuestos sobre la propiedad?

¿Sabía que el condado lo considera un área "donante"? Esto se debe a que la mayoría de los ingresos por impuestos a la propiedad que usted paga

actualmente al Condado son redistribuidos por el Condado a sus proyectos y otras áreas "no donantes" del Condado de Miami-Dade no incorporado. Cuando

se convierta en parte de Miami Springs, sus impuestos a la propiedad seguirán siendo locales, para realizar mejoras significativas en sus carreteras,

inundaciones, iluminación y problemas de tráfico, así como brindar mejores servicios policiales y tiempos de respuesta.

Sabemos que continúa recibiendo información errónea sobre aumentos de impuestos ridículos y otras tácticas de miedo de un grupo pequeño, pero bien

financiado. Ignoran y niegan los problemas muy reales de inundaciones, carreteras deterioradas, tráfico y servicios policiales retrasados que han estado

ocurriendo y aumentando en su área durante más de 20 años. Solo usted es consciente de los impactos negativos y costosos que estas condiciones crean para

su negocio y sus futuras oportunidades comerciales.

Agradecemos la oportunidad de brindarle información sobre la anexión y responder cualquier pregunta. Nuestro administrador de la ciudad, William

Alonso, y yo estamos disponibles para usted por teléfono, correo electrónico o para reunirnos en su ubicación o en la nuestra. No dude en comunicarse con

uno de nosotros en la información de contacto a continuación.

¡Esperamos tener la oportunidad de escucharlo, responder sus preguntas y trazar un futuro exitoso juntos!

Atentamente,

Maria Puente Mitchell, Alcaldesa

City of Miami Springs

VISIT THE CITY OF MIAMI SPRINGS ANNEXATION WEBSITE AT: WWW.YES-TO-MIAMISPRINGS-ANNEXATION.COM

201 Westward Drive - Miami Springs, Florida 33166

Tel: (305) 805-5006 Fax: (305) 805-5028

City of Miami Springs

Maria Puente Mitchell, Mayor

Office of the Mayor

CITY OF MIAMI SPRINGS ANNEXATION INFORMATIONAL SHEET

Miami Springs Mayor Mitchell, City Manager Alonso and Police Chief Guzman have had the pleasure of hosting several meetings with business and property owners in the annexation area to listen and answer questions regarding the Miami Springs Annexation. While the business and property owners have been overwhelmingly appreciative and enthusiastic to learn of the many benefits that annexation will provide to their area, the uppermost request has been that the millage rate be reduced to a level of minimal impact on property taxes.

We are happy to report that the City listened and in December 2022, the City Council passed a resolution further lowering its millage to 2.5 – 3.0 upon annexation.

This commitment represents a millage rate comparable to that of unincorporated Miami-Dade County and other municipalities. In return, the annexation area will receive improved services and benefits. The City also plans to establish an Advisory Board composed of members of the annexation area to ensure that the interests and needs of the area are communicated and addressed.

We know that business and property owners want and deserve the facts on what the real millage rate will be and the true dollar impact on the property tax bill.They also want and deserve to hear about the many benefits of annexation. Miami Springs is fully committed to working with the business and property owners to establish a joint vision and plan for a thriving commercial and industrial park in the annexation area.

PROPERTY TAXES: THE MILLAGE RATE WILL BE 2.5 – 3.0 UPON ANNEXATION

There are 805 properties in the 1.6 square mile Miami Springs annexation area.

The median assessed value of a property in the area is $537,000 This means that at a 2.5 millage the annual increase to a median property would be $318. At a millage of 2.7 the increase would be $426 annually.

At a millage of 2.5, 65 % of the properties would see less than a $500 increase per year.

At a millage of 2.7, 59% would see an increase of less than $500 a year.

Miami Springs is committed to maintaining or further reducing this millage rate in future years.

Our 10-year record of consistently reducing the millage rate reduction speaks for itself.

IMPROVED SERVICES & BENEFITS OF ANNEXATION

Designated Police Officers & Police Sub-Station

Significant Investments in Stormwater & Flood Control Improvements

Significant Improvements to Streets, Sidewalks, Lighting & Landscaping

Efficient & Timely Permitting Available at City Hall

Establishment of City Advisory Board composed of annex area business/property owners.

“Open Door Policy” at City Hall for residents and business owners to meet with City Manager and Department Directors.

City represents the interest of the annex area at the Federal, State and County level.

City pursues Federal and State grants for infrastructure and other improvements.

CITY OF MIAMI SPRINGS ANNEXATION INFORMATIONAL SHEET

On December 12, 2022, The city council passed this resolution expressing the City's intent to lower tax rates upon annexation.

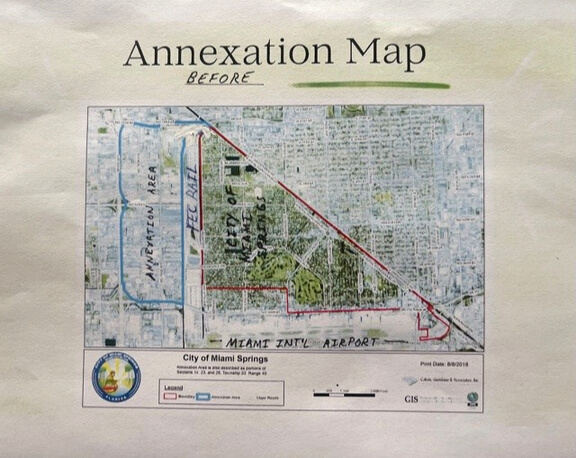

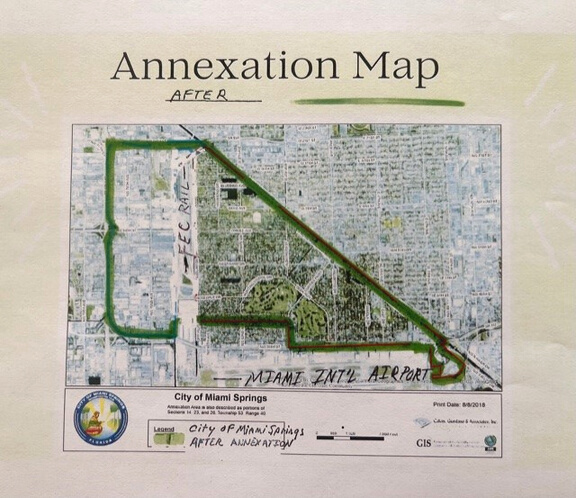

Annexation Map

Watch Mayor Mitchell discuss the benefits of annexation to the property owners in the annex area.

If you have any questions on annexation

Please email:

Mayor Maria Puente Mitchell

(305)-962-5545

City Manager

William Alonso

(305) 805-5011